Award-winning PDF software

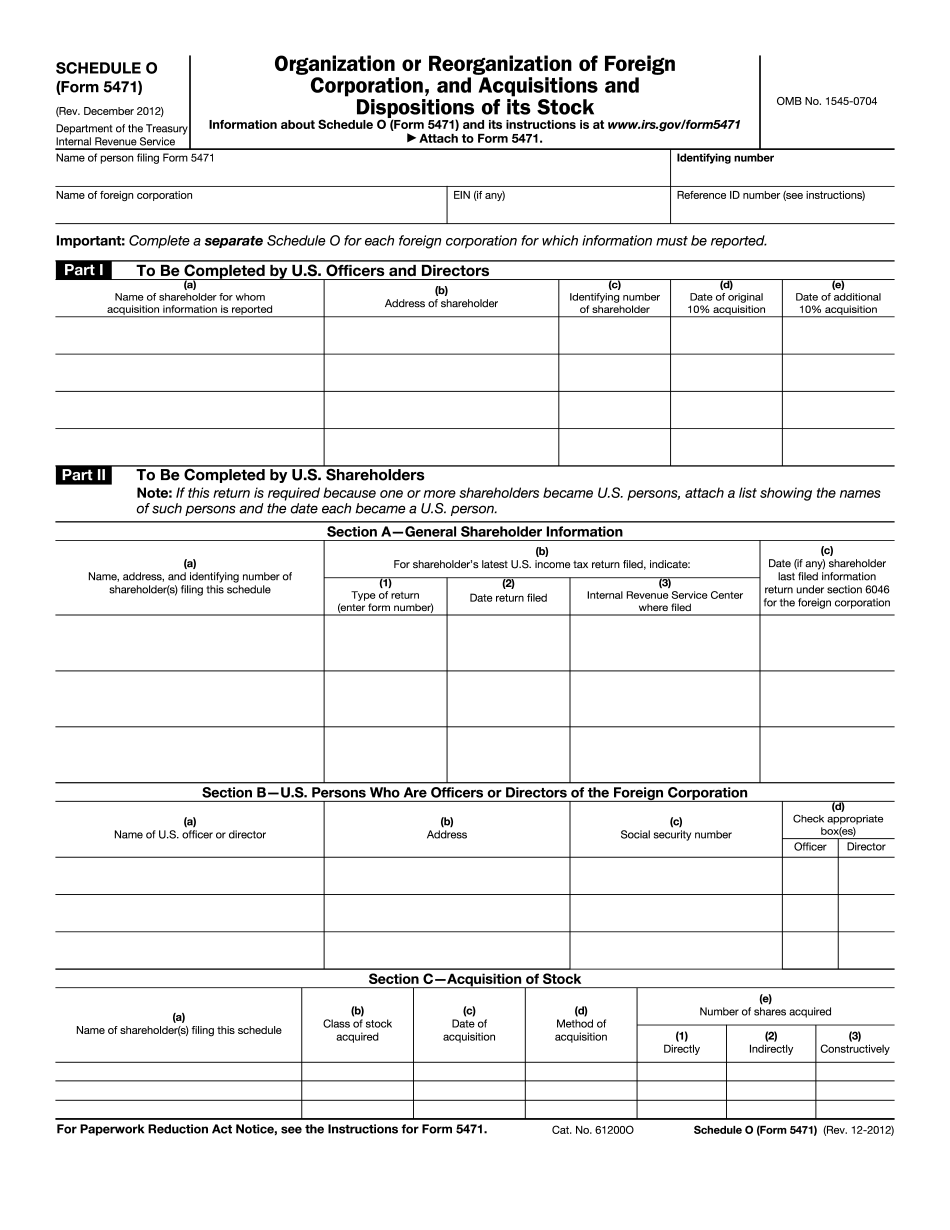

Chula Vista California online Form 5471 (Schedule O): What You Should Know

To Be Completed by U.S. Officers: To be completed by U.S. officers with information from the original U.S. person who filed Form 1120S, Statement of Information From the Person Filed Under Section 1120 of the Code, Section 2071, and Section 2101. In Form 1120S, statement of information from the foreign person. Generally, a foreign person must give “a statement of information from the person who has acquired, or disposed, or proposes to acquire, control over the controlled foreign corporation.” Thus, Form 1120S must disclose the name and principal place of domicile of the person that filed the previous form; or the name and principal place of control of the person that filed the original form. There is one exception, however. The names and principal places of control of foreign persons that are U.S. persons, and control of foreign corporations that are U.S. persons or corporations that are U.S. corporations, may be omitted from Form 1120S. Thus, Form 1120S will not contain information about a person's name and foreign residence only. The form should clearly indicate, however, that the purpose of information reported is to meet Section 1456. In particular, the statement of material changes on Form 1120S need not include any specific personal information. Form 990 is used to report a failure to meet U.S. reporting and payments requirements. (Internal Revenue Code, section 6039D). If the Form 990 is not filed, the filing requirement will be waived. (Internal Revenue Code, section 6041.) Form 990 is necessary as a prerequisite to payment of taxes, penalties, interest and interest on U.S. property with respect to property held pursuant to an exchange of securities under Sections 12 and 144 of the Foreign Bank and Financial Accounts Tax Act. (Internal Revenue Code, section 6041 and section 2071.) Form 990, Statement of Underpayment of Tax (SF 8939) is used by tax collectors to determine the proper collection of taxes arising from income earned by sub-chapter S. (Internal Revenue Code, section 6501). If a U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chula Vista California online Form 5471 (Schedule O), keep away from glitches and furnish it inside a timely method:

How to complete a Chula Vista California online Form 5471 (Schedule O)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chula Vista California online Form 5471 (Schedule O) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chula Vista California online Form 5471 (Schedule O) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.